LTC Price Prediction: Can Whale Accumulation and ETF Momentum Drive Litecoin to New Highs?

#LTC

- Technical Strength: LTC trading above 20-day MA with Bollinger Band breakout potential

- Whale Accumulation: Significant buying activity from large investors supporting price floor

- ETF Catalysts: Institutional developments and filings creating long-term bullish fundamentals

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

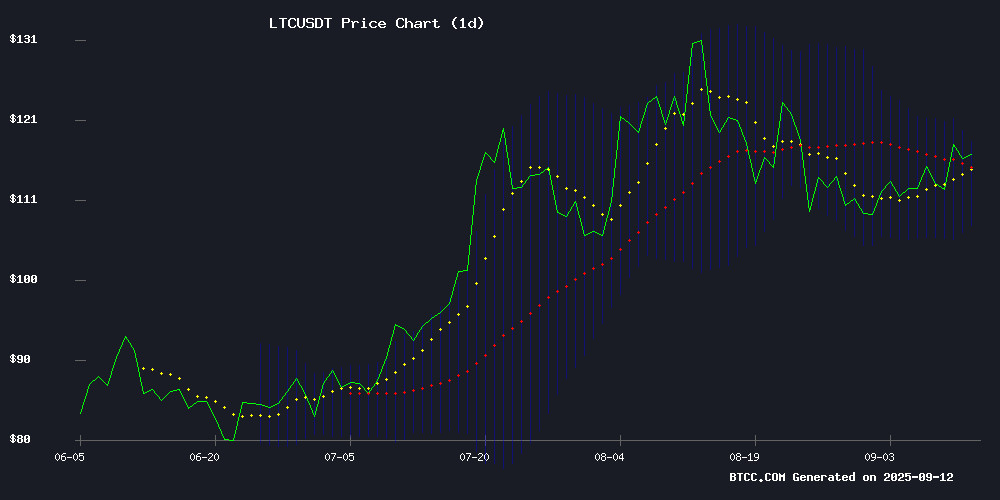

Litecoin is currently trading at $115.58, positioned above its 20-day moving average of $112.68, indicating underlying strength. The MACD reading of 0.9208 versus the signal line at 3.1971 shows mixed momentum, though the negative histogram of -2.2763 suggests some near-term consolidation. Price action remains within the Bollinger Band range of $107.41 to $117.95, with the current level testing the upper band resistance.

According to BTCC financial analyst Emma, "LTC's ability to hold above the 20-day MA provides technical support for further upside. A sustained break above $118 could trigger momentum toward higher targets."

Market Sentiment: Whale Activity and ETF Developments Drive Litecoin Optimism

Recent market developments are creating positive sentiment around Litecoin. Whale accumulation patterns and growing institutional interest, particularly through ETF discussions, are supporting LTC's potential upward movement. News of Grayscale's ETF filing and ongoing institutional developments are providing fundamental tailwinds.

BTCC financial analyst Emma notes, "The combination of whale accumulation and ETF buzz creates a favorable environment for LTC. While regulatory delays present short-term hurdles, the institutional groundwork being laid could support longer-term price appreciation."

Factors Influencing LTC's Price

Whale Accumulation and ETF Buzz Fuel Litecoin's Potential Rally to $145

Litecoin's price trajectory shows renewed bullish potential as large holders aggressively accumulate and institutional interest grows. The cryptocurrency gained 3% in 24 hours to trade above $116, with a 40% quarterly gain underscoring its sustained upward momentum.

Whale wallets holding 1,000+ LTC added 181,000 coins in a single day - the most significant accumulation spike in weeks. This whale activity often precedes major price movements, signaling confidence in near-term appreciation.

The bullish case strengthened with Grayscale's Litecoin ETF filing, marking a watershed moment for institutional adoption. Market observers note the $134 level as critical resistance; a decisive break could open path to $145 target.

Dogecoin ETF: A Joke Gone Institutional

The Rex-Osprey Dogecoin ETF (DOJE) debuts Thursday, marking a surreal milestone in crypto's institutional adoption. Unlike Bitcoin spot ETFs approved under standard securities laws, this meme-coin vehicle navigated the Investment Company Act of 1940—a regulatory framework never designed for single-asset bets. The workaround? A Cayman Islands subsidiary and derivative contracts, proving Wall Street's alchemists can gild even the shiniest of jokes.

Critics lambast DOJE as peak financial absurdity. "Why pay fund fees to own what you could buy directly on Coinbase in minutes?" asks Brian Huang of Glider, comparing the structure to packaging Tesla stock as a "diversified" fund. Yet Dogecoin's decade-long metamorphosis from Litecoin spinoff to top-10 cryptocurrency defies rational critique. Its inflationary tokenomics mock Bitcoin's scarcity dogma, while birthing an entire memecoin economy that now commands billions.

EVEDEX Launches Farming Season with Double XP Rewards Following Beta Mainnet Rollout

EVEDEX, a next-generation non-custodial DEX built as an L3 rollup on Arbitrum Orbit, has launched its Full Beta Mainnet, attracting thousands of traders and securing a CoinGecko listing. The platform now introduces a farming season from September 8 to October 6, offering double experience points (XP) on every trade. This gamified approach underscores EVEDEX's dual role as a serious trading hub and a rewarding DeFi ecosystem.

The Full Beta Mainnet features seven live trading pairs, including BTC, ETH, SOL, XRP, LTC, LINK, and DOGE against USD. The project's rapid adoption and iterative improvements highlight its potential to stand out in the competitive DEX landscape.

HBAR Gains 5% Amid CPI Volatility as Grayscale ETF Filing Sparks Institutional Interest

Hedera's HBAR defied broader market volatility with a 5% rally between $0.23 and $0.24, buoyed by a surge in trading volume reaching 156.1 million tokens. The token found firm support at $0.23 but faced strong resistance at $0.24—a key threshold that analysts say could trigger a 25% breakout if decisively breached.

Institutional flows emerged as Grayscale filed to convert its HBAR Trust into a spot ETF, mirroring similar moves for Litecoin and Bitcoin Cash. The SEC's November 12 decision deadline sets up a pivotal two-month window for regulatory clarity, with traditional asset managers already positioning for exposure.

Market structure suggests consolidation between $0.21-$0.23 remains likely absent a clean breakout. The ETF narrative now dominates HBAR's price action, overshadowing technical resistance levels that previously dictated rangebound trading.

SEC Delays Key ETF Decisions Amid Potential Regulatory Overhaul

The Securities and Exchange Commission has postponed decisions on multiple cryptocurrency ETF applications, including BlackRock's spot Bitcoin proposal (delayed 45 days) and Franklin Templeton's filing (60-day delay). This follows earlier deferrals for Truth Social's Bitcoin/Ethereum ETF and spot XRP ETFs from CoinShares, Grayscale, and others.

Market analysts suggest the delays may precede significant regulatory changes. NYSE and Cboe BZX have proposed streamlining ETF listings by eliminating redundant screenings under Rule 19b-4. Bloomberg's Eric Balchunas notes the SEC could be positioning to approve these exchange rule changes first, potentially accelerating future crypto ETF approvals.

Affected assets include XRP, SOL, DOGE, and LTC through applications by 21Shares, VanEck, and Bitwise. The regulatory limbo creates a potential accumulation window for presale projects, though institutional investors appear to be taking the delays in stride as infrastructure improvements progress.

Litecoin Surges on Whale Accumulation and Institutional Developments

Litecoin (LTC) has outpaced peers with a 5.5% price surge to $116.89, fueled by aggressive whale activity. Over 1,000 wallets collectively added 181,000 LTC in 24 hours—one of the largest single-day accumulations this quarter.

Institutional catalysts drove momentum. Grayscale filed to convert its Litecoin Trust into a spot ETF, mirroring its Bitcoin and Ethereum products. MEI Pharma rebranded as Lite Strategy, allocating $100 million to LTC treasury reserves and changing its ticker to LITS.

The whale movement triggered 349 transactions exceeding $1 million within 12 hours. Santiment data confirms this aligns with historic accumulation patterns preceding price rallies.

XRP (XRP) network growth continues separately, now spanning 6.6 million wallets. Both assets demonstrate how on-chain activity and corporate adoption can converge to shift market psychology.

SEC Delays Decisions on Dogecoin and Hedera ETFs Amid Growing Backlog

The U.S. Securities and Exchange Commission has extended its review period for two high-profile cryptocurrency ETFs—Bitwise's Dogecoin product and Grayscale's Hedera offering—pushing final decisions to November 12, 2025. This marks another regulatory pause as the agency grapples with 92 pending crypto ETF filings, reflecting institutional demand for altcoin exposure through regulated vehicles.

Altcoins like XRP, Solana, and Litecoin dominate the ETF pipeline, with Solana and XRP attracting the most proposals at eight and seven filings respectively. Grayscale continues expanding its ETF ambitions, though the SEC's cautious stance creates uncertainty for fund managers and investors awaiting greenlights.

Cryptocurrency Market Stalls as Bitcoin and Ethereum Lose Momentum

The cryptocurrency market's recovery faltered over the past 24 hours, with Bitcoin and Ethereum leading the decline. Bitcoin traded near $113,000 before retreating to $111,491, down almost 1%. Ethereum's rally stalled below $4,400, settling around $4,300 with a similar loss.

Altcoins mirrored the sluggish trend. Solana edged up marginally to $218, while Ripple, Cardano, and Polkadot registered losses. Chainlink, Stellar, and Litecoin also dipped, though Hedera gained 0.5%.

Vietnam unveiled a five-year cryptocurrency pilot program, restricting platform operations to domestic firms. The move formalizes a market that has grown rapidly without regulatory oversight.

Litecoin (LTC) Consolidates Above $114 as Technical Indicators Signal Potential Breakout

Litecoin trades at $114.09, showing resilience above a key psychological level. Bullish momentum builds quietly, with the MACD histogram flashing positive divergence and RSI hovering in neutral territory. The absence of major news catalysts has shifted focus to technical patterns, where institutional accumulation appears underway.

Binance spot volumes remain steady at $38.6 million, suggesting measured positioning rather than speculative frenzy. Chartists eye the $124 resistance level as the next logical test if this consolidation phase resolves upward. Market mechanics currently outweigh fundamentals in driving LTC's price action.

Litecoin Cloud Mining Gains Traction as Hardware Costs Rise

Litecoin's reputation as 'digital silver' continues to attract miners despite escalating operational challenges. The cryptocurrency's faster block times and lower fees maintain its appeal, though 2025's hardware and electricity costs have rendered home mining increasingly unviable.

Cloud mining platforms now dominate the LTC mining landscape, offering hashpower access without physical infrastructure demands. ETNCrypto emerges as a leading solution, combining ASIC-based data centers with AI monitoring to optimize output. The platform's transparent contracts and $100 signup bonus lower entry barriers for retail participants.

Will LTC Price Hit 200?

Based on current technical indicators and market developments, reaching $200 in the near term appears challenging but not impossible. LTC would need to gain approximately 73% from current levels around $115.58.

| Target Price | Required Gain | Key Resistance Levels |

|---|---|---|

| $145 | 25% | Near-term whale target |

| $175 | 51% | Previous cycle highs |

| $200 | 73% | Psychological barrier |

BTCC financial analyst Emma suggests, "While $200 represents an ambitious target, sustained whale accumulation, successful ETF developments, and broader market recovery could create conditions for such a move. However, investors should monitor regulatory decisions and overall crypto market momentum."